Summary

This is an in-depth guide about the role of a virtual payroll assistant, including the key responsibilities such as timesheet validation and compliance, the skills necessary to be successful in a remote setting, and a chronological career ladder of desired employees.

Did you hear that the PwC estimates that the overall cost of payroll errors per company in the FTSE 100 lies between 13 and 40 million dollars annually? Although payroll may not sound like an important thing, it is silently killing your profits.

That’s why a capable payroll assistant has become a necessity in every business landscape. The number of people in need of payroll assistants is ever-increasing. Therefore, it is the best moment to think of pursuing a career as a payroll assistant.

Go through our detailed breakdown of payroll assistant duties and responsibilities below to get a head start in your new career.

What is a Payroll Assistant?

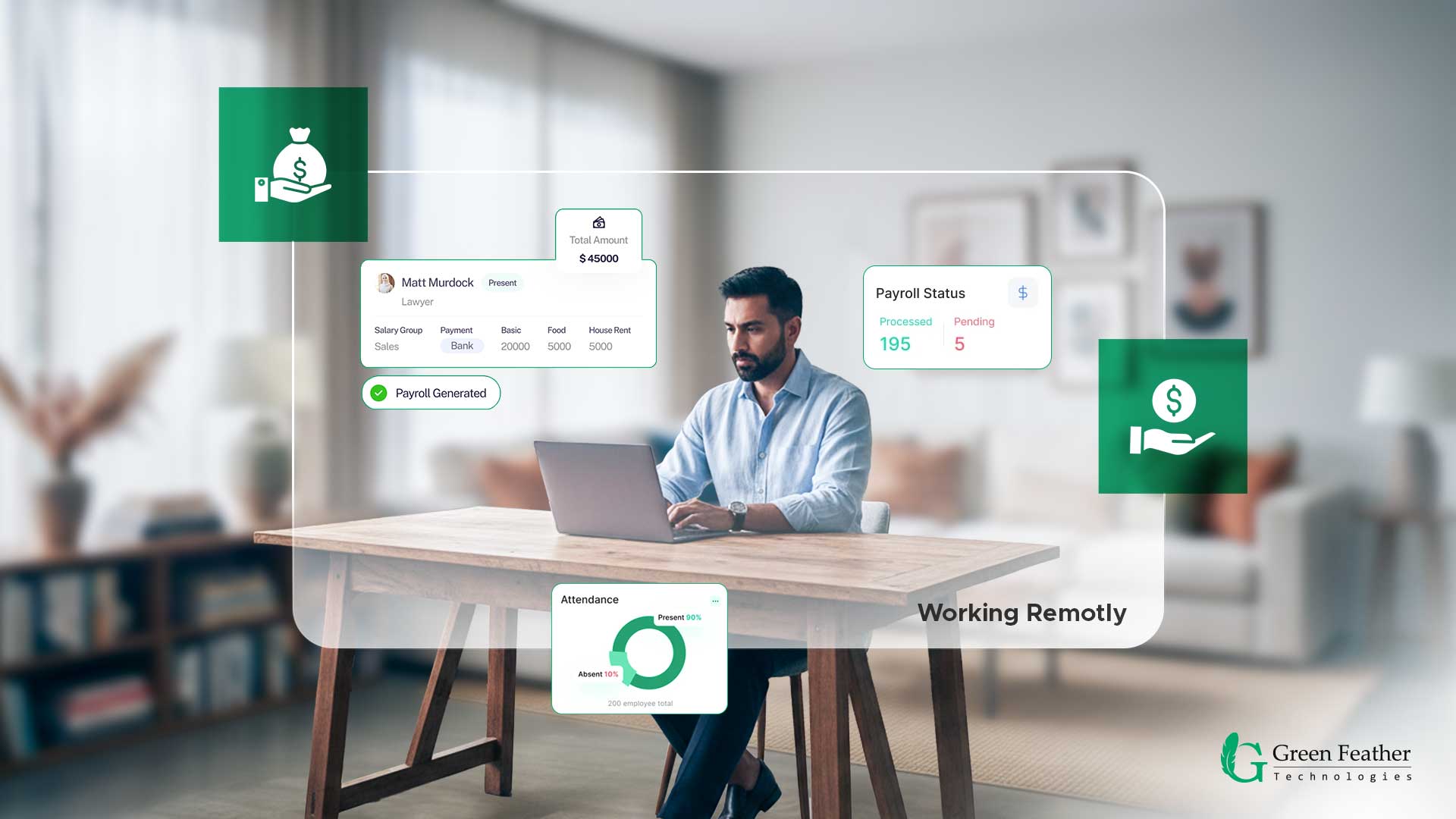

A payroll assistant is an administrative and financial support worker charged with the responsibility of making sure that all the tasks related to the payroll of employees are completed accurately.

In particular, the job of a virtual payroll assistant has to do with the implementation of the following functions off-site. They are the key to the relationship between the HR, which supplies the data on the employees, and the Finance department, which is the one making the final payment.

They handle the whole payroll cycle. It includes –

- Timesheet entry and computation,

- Final payment,

- Record keeping

A payroll assistant supports a remote workforce by ensuring sensitive information is securely stored and managed in the cloud. This is what a payroll assistant means in the new distributed workplace.

What Are the Roles and the Responsibilities of a Payroll Assistant?

The essence of a virtual payroll assistant is to coordinate data streams to ensure accurate paychecks. Their routine is the focus of their activity and attention to detail, as well as following the set procedures.

Timesheet Validation

The initial task of the assistant is to take, confirm, and authenticate the employee timesheets, PTO requests, and expense reports. In an online position, this usually involves verification of digital submissions. It ensures that they have the appropriate information on hours, manager approval.

Data Entry

Payroll assistants also perform various types of data entry. It includes new-hire details, employee wage amendments, and tax and deduction processing in the payroll system. This is a highly demanding task that requires close attention to detail, as a single mistake can affect an employee’s salary.

Payroll Calculation

They help in finding gross pay, deductions, and net pay of employees. A virtual assistant uses specialized payroll software to do these complicated calculations. This means every number is mathematically correct and complies with federal and state/provincial tax regulations.

Payment Processing

Virtual payroll assistants create the payment files and send them to the senior payroll specialist or finance manager for final authorization. This is an essential process for ensuring adherence to the payroll calendar’s tight schedule.

Discrepancy Resolution

Payroll assistants answer questions and complaints on pay differences, absent hours, or wrong deductions. They are to check the time sheets and payroll reports, talk to the employee, and amend the next pay period.

Bank Coordination for Salary Disbursement

The assistant always serves as an ambassador between the company and the banking institutions after internal approval. This includes uploading certified payment files, such as ACH or wire transfer batches, to banking portals. They also keep an eye on the status of direct deposits.

Employee Support

As the primary channel of contact for payroll concerns, the virtual assistant will also assist employees. They do it by clarifying their pay stubs, W-2 forms, and company deduction policies. It is usually managed via a special online portal or email support.

Compliance and Reporting

One of them is to support end-of-period tasks, including producing reports for senior management, tax authorities, and auditors. They ensure that all payroll operations comply with federal, state, and local labor laws and tax regulations, which is a 24-hour task for a virtual professional.

What Is the Way to Become a Payroll Assistant?

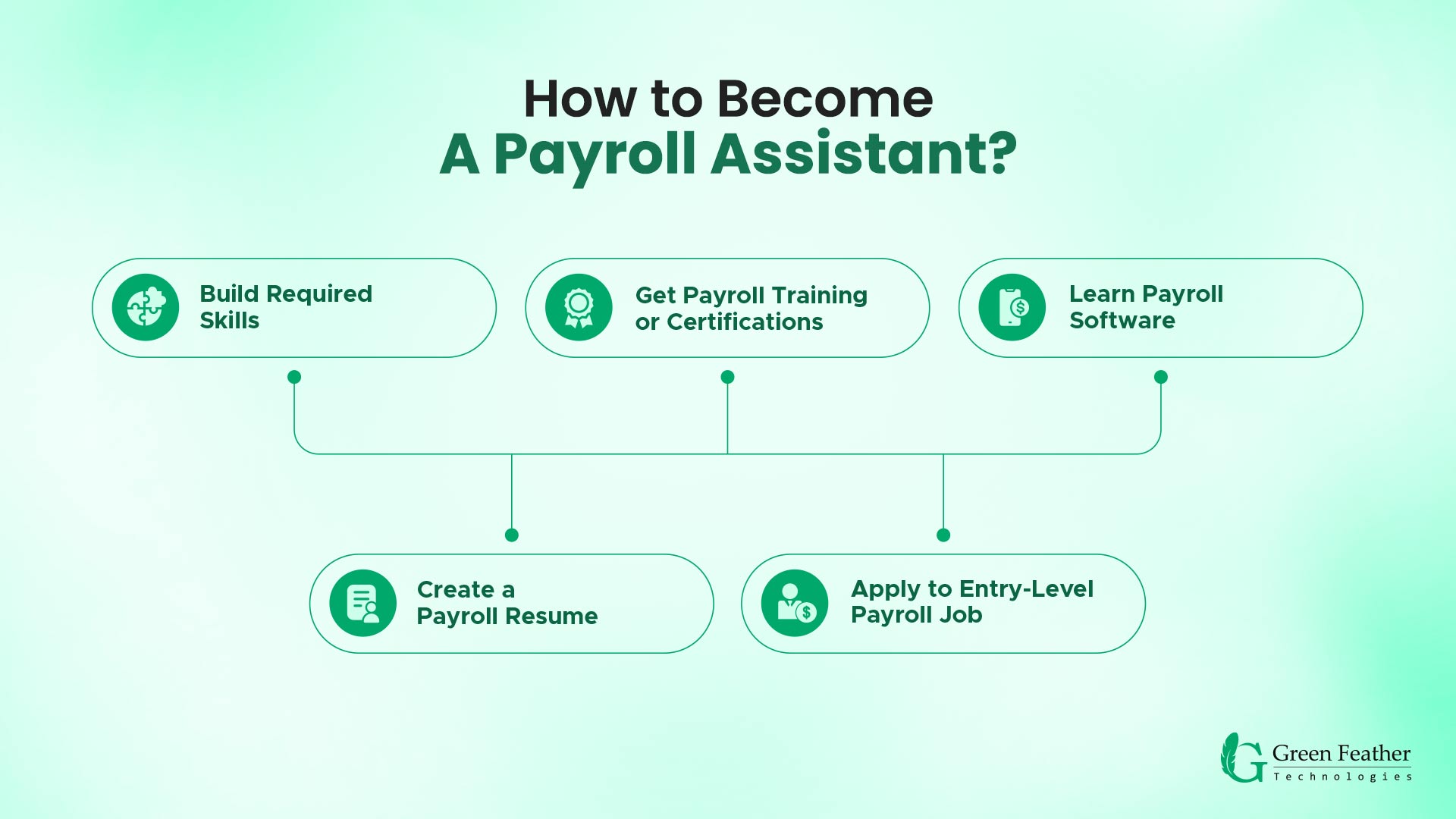

In case you are good at numbers and want to have a stable, remote job, you can become a virtual payroll assistant with dedicated preparation. These are the essential steps to begin a career.

Step 1: Build Required Skills

Begin by building up good computational abilities, attention to detail, and the ability to use digital tools. These are the basics of any virtual administrative position. It is also very advantageous to have a basic knowledge of accounting principles.

Step 2: Receive Payroll Training or Certifications.

Although a degree is not a must, special training or certification will go a long way in enhancing your resume. Search programs provided by organizations such as the American Payroll Association (APA) to acquire the technical and legal aspects of payroll.

Step 3: Learn Payroll Software

Knowledge of payroll software that complies with industry standards is non-negotiable. Online courses or self-study on the practical application of these systems are essential for survival in a virtual environment. You can start learning with free data entry software solutions.

Step 4: Create a Payroll Resume

Target your resume to your mathematical accuracy, speed at entering data, and any experience in financial record-keeping. Emphasize your expertise in the field of remote communication tools and your ability to work with confidential information safely.

Step 5: Submit Application to Entry-Level Payroll Jobs.

The initial process is to seek entry-level jobs, which include Virtual Payroll Assistant or Remote Payroll Clerk positions. Think of the part-time contract work to acquire first experience and prove your credibility and ability to work remotely.

Essential Payroll Assistant Skills

To be a successful virtual payroll assistant, you need to have a combination of technical abilities and soft skills required to work remotely. These include –

Payroll Software Expertise

The most essential technical skill that is required in a virtual position is the ability to navigate, input data, and produce reports fast and correctly in the complicated payroll management systems.

Knowledge of Regulations

A good current understanding of federal, state, and local wage, tax, and labor laws is critical to ensure that there is compliance. It also helps to prevent legal mistakes, which are costly to the employer.

Accounting Knowledge

Payroll assistants don’t have to be qualified accountants, though they should have some basic understanding of accounting principles. It involves the General Ledger (GL) coding, journal entries, and the effect of payroll on the balance sheet.

Mathematical Accuracy

There is an extremely high degree of numerical accuracy required of the position. Whether it is hourly pay or complicated tax deductions, assistants should make sure that everything is flawless in the calculations.

Time Management

There are stringent deadlines in payroll that can not be compromised. Virtual assistants should be organization and time management experts in order to make sure that everything is carried out on time, despite the time zone differences.

Communication Skills

There should be excellent written and oral communication skills in order to respond to the question related to employee pay well and ensure that there is a professional connection with the remote HR and Finance individuals.

Organizational Skills

Virtual assistants handle large volumes of paperwork, employee-sensitive documents, and tax records. An effective digital organization system is essential in terms of efficiency and safety.

Problem-Solving

They should be in a position to research and solve arduous payroll anomalies on their own, and this involves critical thinking and systematic handling of data.

Confidentiality

Since they deal with sensitive personal and financial information of the employees, a virtual assistant should exhibit the highest order of discretion and follow the data privacy protocols at any given time.

Speed and Accuracy of Data Entry.

The payroll assistant job involves a large volume of data processing. That’s why the speed of information entry into payroll systems and the accuracy of that entry are direct contributors to timely, error-free pay runs.

Conclusion

The role of a virtual payroll assistant is an outstanding entry point for a stable and meaningful career in finance and administration. For new job seekers, focus on skill development in compliance and software, as these are the true value drivers in a remote environment.

Payroll has unbelievable long-term stability since the role is non-cyclical and the need to be accurate increases with the complexity of the regulations.

FAQs

What is the average salary range for a payroll assistant in different industries?

Here’s a breakdown of the annual payroll assistant salary range in different industries –

| Industry | Annual Salary Range (USD) |

|---|---|

| Legal Industry | $49,000 - $69,000 |

| Financial Services | $43,000 - $59,000 |

| Healthcare Industry | $44,000 - $61,000 |

| Real Estate Industry | $44,000 - $59,000 |

How does the role of a payroll assistant differ in small businesses versus large corporations?

In a small business, a payroll assistant can do end-to-end payroll with limited specialization and can also be an HR or bookkeeper. In a large company, the position is more specialized. It’s often targeted to a specific geographic area or payroll function and falls under a larger, dedicated payroll department.

What are some of the typical career development opportunities available following a payroll assistant?

The most popular paths of promotion include Payroll Specialist, Payroll Manager, and transfer to the corresponding roles of HR Assistant, Benefits Administrator, or Staff Accountant. Further education, like getting an Accounting degree, may result in a Controller or Financial Analyst position.

What software programs could be useful for payroll assistants to learn?

Familiarity with software like ADP, Paychex, QuickBooks Payroll, Gusto, and dedicated human resources information systems. The experience with Microsoft Excel and safe cloud communication software, such as Slack or Teams, is also necessary in the workplace, both online and in person.

Which payroll-related certifications do employers hold in the highest respect or regard?

The FPC or Fundamental Payroll Certification is essential in entry and middle-level positions. This certification exemplifies fundamental competence in the field. In the case of highly qualified professionals, the CPP or Certified Payroll Professional is the best one. The American Payroll Association is the authorizer of this certification.