Summary

In this article, we talk about how to outsource payroll processing to a virtual assistant. Any business struggling to free itself from payroll processing will find its solution in outsourcing payroll processing to a virtual assistant here.

Almost every business learns at some point that it spends about 21 days a year on payroll processing, according to a survey by QuickBooks Payroll. Payroll processing in general doesn’t seem like a big deal, but it surely takes away a lot of your time and resources.

The solution? It’s simple: you outsource payroll processing. But not everyone knows how to do it. That’s why we are here with the ultimate guide on how to outsource payroll processing to virtual assistants. Let’s not waste any time and get right into it.

What is Payroll Processing Outsourcing?

Payroll processing simply means you are giving all the operational tasks of paying your employees to an outside company or individual. It can be as minor as calculating pay rates or as critical as tax deductions. They can also help out with generating payroll reports.

In short, anything related to payroll, they will do it for you. You can choose either a full-service payroll provider or a virtual assistant to suit your needs. Each option has its own pros and cons.

When to Outsource Payroll Processing to a Virtual Assistant?

While anyone can benefit from outsourcing payroll processing, not everyone truly needs it. Consider the following scenarios as an indication that you should hire a virtual assistant for payroll processing.

- Rising Payroll Complexity: If you have expanded your team or added contracts, you are likely dealing with a larger payroll now. Given the increased payroll complexity, it’s better to outsource payroll processing than to handle it in-house.

- Teams are Overloaded with Payroll: The most amount of added payroll pressure falls onto the manager or the HR. It becomes quite difficult with limited team members. Outsourcing payroll frees them to focus on strategic planning, while you handle payroll through a virtual assistant.

- Frequent Errors or Risks: When you notice many errors or issues in the payroll process, it likely indicates a problem in your system. The quickest solution in that case is outsourcing it to a capable virtual assistant.

- Need a Scalable Payroll: Payroll processing can be challenging for businesses with seasonal hires or project-based workers. Getting a virtual assistant there who can adapt to your needs is the perfect solution.

- FreeUp Internal Resources: In-house payroll processing can take up a lot of your internal resources without you even realizing it. If you notice anything like that, outsource payroll processing immediately to leverage those resources for growth.

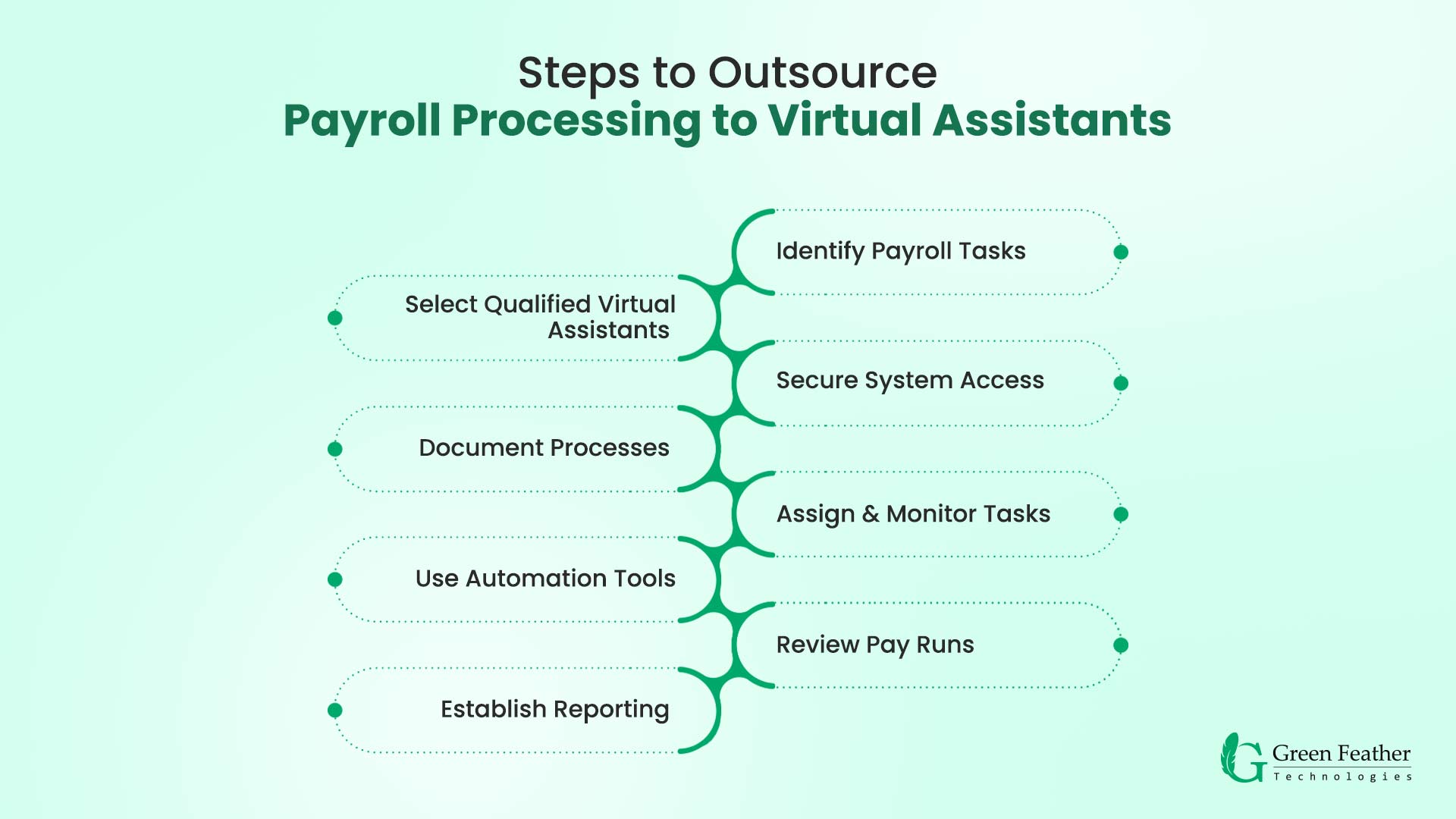

Steps to Outsource Payroll Processing to Virtual Assistants

Outsourcing payroll processing isn’t difficult when you know the right approach to this. Here are the exact steps you need to follow when outsourcing the payroll process to virtual assistants –

Identify Payroll Tasks

Right off the bat, find out the exact payroll tasks you need help with. Is it collecting timesheets or applying pay rates, or simply processing deductions? It will give you a direction on which type of virtual assistant to outsource for your business.

Select Qualified Virtual Assistants

While payroll processing might seem simple, it requires some expertise to be flawless. Look for someone who knows how to process payroll. They should also be aware of the payroll software you use. Lastly, someone with a basic understanding of tax goes a long way.

A good way to evaluate the perfect candidate would be with a short paid task. Use the list from the previous step to assign a short paid task from there. Or you can also ask for references to verify whether the VA is capable or not.

Secure System Access

Give VAs only the access they need. Use role-based permissions in payroll software alongside a multi-factor authentication setup. If direct access to bank transfers is required, use approval workflows so payments require a manager’s sign-off. Track all logins and maintain a user access log for audits.

Document Processes

Don’t want to change your payroll process? Then, make sure you document it thoroughly. The way you like to validate timesheets, or pay rates to apply, or the kind of overtime rules you follow, document everything. Then, after you hire the virtual assistant, you simply provide them with the clear documentation.

Assign & Monitor Tasks

The next step in outsourcing payroll to a virtual assistant is assigning them duties with deadlines tied to your payroll cycle. Use a task manager to assign all these. Then, set up weekly check-in sessions to discuss issues or improvements to keep them monitored and in line with your process.

Use Automation Tools

When it’s about efficiency, there is no alternative to automation these days. If you combine a virtual assistant with the right kind of automation tools, you can achieve the ultimate efficiency.

Set them up with tools that help in directly importing timesheets from your time trackers. Or get connected to automated reminders for missing timesheets.

Review Pay Runs

Never let the pay runs go unchecked. No matter how capable the virtual assistant is, they should always prepare a draft of the pay run before processing it. The draft will highlight anomalies like excessive overtime, unusual benefits, or adjustments. You should review the draft first, then approve the run.

Establish Reporting

Always set a fixed date or time for receiving regular payroll reports from the virtual assistant. It will include things like total payroll cost, taxes withheld, benefits, and everything altogether.

Benefits of Outsourced Payroll Services

You might be wondering, “Is outsourcing payroll services truly worth it?” Well, if that’s the case, check out the benefits below.

Reduced Time and Costs

Opting for outsourced payroll services helps cut the overhead costs of having an in-house payroll team. Not only that, with the burden of payroll handed over to an external party, your business frees up time to do other strategic stuff.

Better Accuracy and Compliance

When you have a documented process backed by a checklist-driven workflow, you will see a significant drop in errors. It becomes almost flawless if you have a bookkeeping virtual assistant specializing in payroll processing by your side as well.

Flexible, Scalable Payroll Support

The best part of outsourcing payroll processing is the flexibility it provides. For example, if you get 10 seasonal hires who add payroll work, you can scale up the payroll support from the virtual assistant. When the season ends, you simply scale it back.

Stronger Data Protection

You might think outsourcing exposes your data security. While it’s true to some extent, the right virtual assistant understands all of that. Because of that they use robust encrypted systems to ensure your data is protected at all costs.

More Focus on Core Operations

With all your resources freed from the shackles of payroll process, you can utilize them for core operations. You don’t have to worry anymore about the pay runs or tax filings. The virtual assistant will take care of that.

Lower HR and Admin Workload

Most of the time, payroll duties fall onto either the HR team or the admin team. Because of that, they get stuck with duties that don’t truly help them excel in their work. Outsourcing payroll to a virtual assistant takes off all that load from them so they can finally do their dedicated work properly.

Conclusion

As you can already tell, outsourcing payroll processing to a virtual assistant can immediately make your business more efficient. You free up your time, resources while cutting down costs as well.

However, it all comes down to hiring a capable virtual accounting assistant. That’s where knowing how to outsource payroll processing to a virtual assistant helps you.

FAQs

How to choose payroll software for a remote VA team?

The most important feature to look for in payroll software for a remote VA team is whether it’s cloud-based. Next, you should prioritize the secure multi-user access feature as well as the role-based permission settings.

How Much Does It Cost to Outsource Payroll to a VA?

It varies depending on the type of service you choose. If you hire a freelance virtual assistant, rates range from $10 to $50 per hour, depending on expertise. In the case of managed services, the cost goes up to $1500 to $3500 per month.

What information do you need to provide to a payroll virtual assistant?

You at least have to provide the following details to a payroll virtual assistant –

- Employee details (names, IDs, bank details, payment method, etc.)

- Pay rates

- Pay Cycle

- Tax withholding information

- Benefits and reimbursement policies

- Timesheets

- Access to payroll software

For the best results, we also recommend handing them a documentation of your current payroll process if you want consistency.

How do I ensure data security when outsourcing payroll?

Your best bet to ensure data security when outsourcing payroll is using secure software. It has to have role-based permission so you can control what they can access. Also, multi-factor authentication settings are a must. Always use encrypted file-transfer methods to prevent data breaches. Get an NDA or data security commitments from the virtual assistant.