Summary

In this article, we explore exactly what a Virtual CFO does and how they can transform your financial strategy. Any business looking to scale up or organise its finances without the high cost of a full-time executive will find the answers on how to leverage virtual CFO services here.

A study by US Bank shows that 82% of businesses struggle with cash flow management. It’s a problem that businesses can easily solve by having a CFO in their business. But hiring a full-time CFO comes with a hefty price tag.

That’s where the solution of hiring a virtual CFO comes into play. It’s a viable solution that many businesses still aren’t taking advantage of. Because most of them still wonder, “what does a virtual CFO do?” It’s finally time to find out. Let’s get into it.

What Is a Virtual CFO?

A Virtual CFO or Chief Financial Officer is an outsourced service provider who provides high-level financial strategy, systems analysis and operational advice to companies on a part-time or retainer basis.

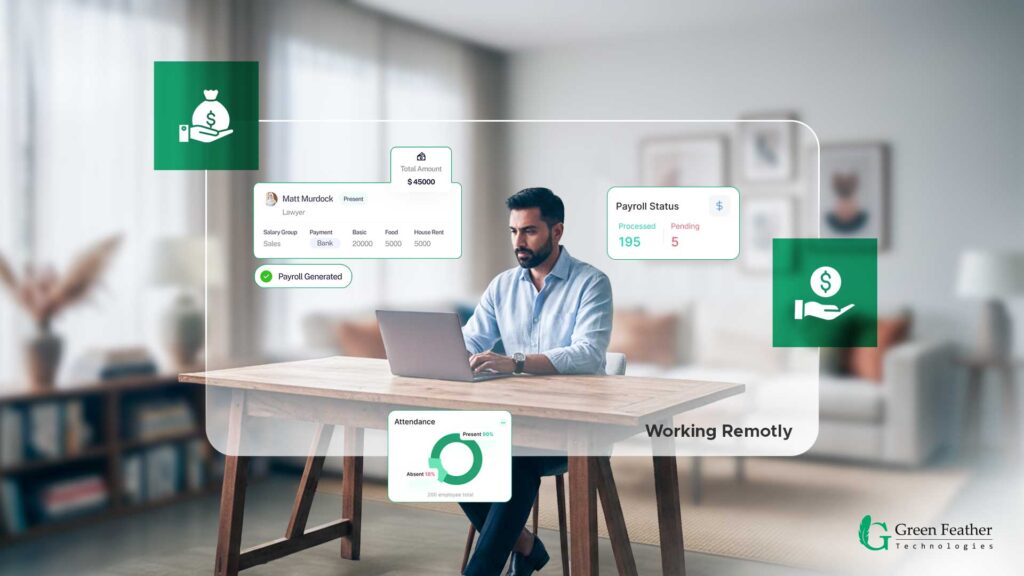

As opposed to a conventional employee, they are operating remotely and, in most cases, they are serving several clients, giving you a range of industry experience in your particular case.

The employment structure and cost are the general distinctions between a virtual CFO and a traditional CFO. A traditional CFO is a full-time, in-house salaried executive with benefits, often costing six figures. An outsourced CFO provides the same level of expertise and strategic oversight but functions as an external partner, making high-level financial leadership accessible to small and mid-sized businesses.

What Does a Virtual CFO Do?

The role of chief financial advisor goes far beyond simple number crunching. They become your strategic partner, and they will assist you in manoeuvring through complicated financial environments. The following is a detailed description of the fundamental responsibilities they deal with.

Financial Planning and Analysis (FP&A)

This is the financial future planning of your business. A finance advisor examines your current financial standing and economic patterns in order to create long-term strategies. They not only make you know what you do with your money, but also how to use it properly to grow.

Budgeting & Forecasting

It is easy to make a budget and hard to adhere to it and predict future revenue. Your finance director will make realistic budgets and make predictions about the future based on past data. This will see you ready during lean months and times of explosive growth.

Cash Flow Management

Cash is king, and lack of it is the nightmare of a business. A virtual CFO will keep track of when your income and expenses are due, so you will never run out of liquidity to do business. They adopt measures that will make the receivable cycles shorter and payables to be optimised.

Dashboarding and Financial Reporting.

You are not supposed to guess the performance of your business. Virtual chief financial advisor establish complete reporting frameworks and real-time control boards. These tools provide you with a visual picture of your financial position at any particular time, allowing you to make evidence-based decisions.

Profitability & Cost Optimisation

It is not about revenue and not being profitable. An outsourced chief financial officer goes down to the lines and finds out what products or services are profitable and what are consuming resources. They also review overheads in order to trim down unnecessary amounts without compromising on quality

Strategic Planning with Decision Support

When you face a major business crossroad, you need reliable advice. You want to open a new branch or start a new line of products, a remote CFO is what you need. They offer financial modelling and strategic thinking to ensure correctness, as well as help to reduce risk.

Risk Management Plus Compliance

Financial risks to every business include market volatility to internal fraud. A virtual finance executive detects these risks at the initial stage and puts internal measures in place to curb them. They even make sure that your business remains within the financial regulations and laws.

Tax Planning & Optimisation

Tax season shouldn’t be a surprise that hurts your bank account. While they work alongside your CPA, a virtual CFO focuses on forward-looking tax strategy. They help structure your finances throughout the year to maximise deductions and minimise tax liability legally.

Capital Structure & Fundraising Support

If you are looking to raise capital, you need your financials to look impeccable. A virtual finance director helps determine the best mix of debt and equity financing. They also prepare the financial presentations and data rooms required to impress investors and secure funding.

Performance Monitoring & KPIs

Measurement can never improve what you have not measured. A virtual finance advisor can determine which Key Performance Indicators (KPIs) are the ones that do have a material impact on your particular industry. They monitor these channels strictly to make sure that the business is on course towards its strategic objectives.

Investor Relations Support

It takes certain financial literacy and transparency in the process of communicating with stakeholders. A chief financial advisor is the one who maintains these relationships by giving reliable and timely reports. They also respond to upper-level financial inquiries and ensure that your investors feel at ease with the management.

When Do You Need a Virtual Chief Financial Advisor?

While many businesses can survive with just a bookkeeper in the early days, there comes a tipping point where you need strategic firepower. Consider these scenarios as a sign that it is time to bring in a virtual CFO.

Revenue Milestones

As your business expands to particular revenue levels, usually the range of about 1-5 million, the complexity of the financial aspect grows exponentially. Basic bookkeeping will not suffice at this point to run the capital flow efficiently.

Scaling Stages

You require a financial strategist in case you are planning on growing operations, aggressively recruiting, or venturing into new markets. A virtual chief financial officer will make sure that your expansion is sustainable. Also, make sure you will not overstretch your resources in the process.

Before Fundraising

Shareholders are keen on each dollar. You need a hire or outsourced CFO to prepare audit-ready financials and forecasts that you are a safe bet. It’s most effective in the case of a Series A or a bank loan.

When In-house Finance is Overwhelmed

When your financial department is choked with day-to-day transactions and is not able to give strategic advice, that is an issue. Virtually delegating high-level strategy to a virtual financial advisor allows your staff to concentrate on operations, as you receive the help you require.

What Are the Benefits of Hiring a Virtual CFO?

You might be asking, “Why not just hire a full-time executive?” The answer often lies in efficiency and ROI. The particular benefits are –

Cost Effective Solution

Hiring a full-time chief financial officer comes with a high salary, bonuses, and benefits. A virtual Virtual finance director provides the same high-level expertise for a fraction of the cost, usually as a monthly retainer, saving your overhead for other critical investments.

Senior Financial Expertise

You have access to a veteran who has probably encountered financial situations in other industries. This experience will enable them to resolve problems more efficiently and creatively than an individual who has worked in a single sector.

Flexible Service Options

On-demand virtual CFO services are highly adaptable. You can scale their involvement up during tax season or fundraising rounds and scale it back during quieter periods, ensuring you only pay for what you truly need.

Unbiased Financial Insights

Internal employees may sometimes hesitate to deliver bad news to the owner. An outsourced virtual CFO provides an objective, third-party perspective, telling you exactly what you need to hear to keep the business healthy.

Scalable Business Support

Your financial requirements vary with the growth of your business. The virtual finance director is an evolving system that adopts more advanced systems and strategies. It happens as your company becomes a mature business from “just a startup”.

Strategic Decision Making

Gut feeling isn’t enough for big business moves. With a remote chief financial advisor, every major decision is backed by data and financial modelling, significantly increasing the probability of success.

Better Compliance Management

Keeping up with new financial rules is a time-consuming task. A virtual CFO keeps your business within the scope of financial procedures to ensure that you are not hit with a fine or a lawsuit.

Conclusion

As you can see, understanding what a virtual chief financial officer does reveals just how vital they can be for a growing company. You get the strategic benefits of a financial veteran without the crippling costs of a full-time executive hire.

The future of financial management is flexible and remote. If you want to stay competitive, integrating a virtual CFO into your team is the next logical step. For businesses looking for top-tier financial guidance, GFT is ready to help you streamline your finances and drive growth.

FAQs

How much do virtual CFOs charge?

Hiring a virtual financial advisor can cost based on hourly rates and monthly retainers. Usually, the experienced virtual CFOs will charge somewhere between $2000 – $6000 every month. Mostly, the beginner or intermediate level remote CFOs offer hourly rates of $11 to $35 per hour.

Is a virtual CFO worth it for small businesses?

Yes, especially for small businesses that are scaling or facing cash flow issues. The return on investment comes from improved cash flow, tax savings, and strategic growth that a standard accountant cannot provide.

Do virtual CFOs handle taxes?

While they oversee tax strategy and planning to minimise liability, they typically work in tandem with a CPA who handles the actual filing. They are there to make sure that you are ready during the tax season all year round.

What is the difference between a Virtual CFO, an accountant, and a bookkeeper?

Transactions are recorded by a bookkeeper. An accountant composes taxes and analyzes history. A virtual chief financial officer is future-oriented–strategy, future-forecasting, and higher-level financial planning are offered to spur business growth.