Summary

In this guide, we have discussed the complete process of how to outsource accounting tasks to virtual assistants. It tells you why you should outsource the tasks, how to decide on the tasks, and how to do it overall.

According to SCORE, small businesses spend around 20 hours per month on accounting and invoicing tasks. But when you are juggling a million things at once, accounting will never strike you as the most exciting part ever. Instead of spending hours crunching numbers, outsource these tedious tasks to a virtual assistant while you focus on growth.

We have this ultimate guide on how to outsource accounting tasks to virtual assistants. Here, we will go through every step you need to take to outsource the perfect virtual assistant who suits your accounting needs. Let’s start.

What Does It Mean to Outsource Accounting Tasks to Virtual Assistants?

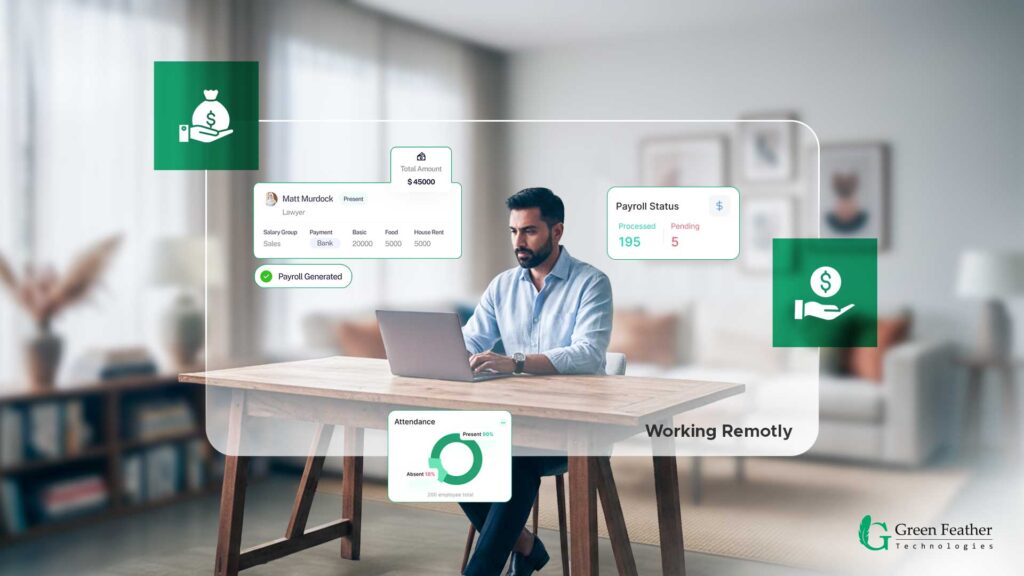

Outsourcing accounting tasks to a virtual assistant is all about dividing accounting duties remotely. Since it involves accounting tasks, the professionals need to have accounting and bookkeeping skills.

The assistant will use advanced digital tools to handle your books, track expenses, and ensure compliance. This is pretty much the gist of outsourcing accounting tasks to a virtual assistant.

You can use this strategy in almost any sector you can think of. For instance, e-commerce businesses do this to reconcile sales across multiple platforms and manage inventory costs. Similarly, a service-based firm may rely on them to ensure an efficient invoicing process while monitoring accounts receivable.

Besides these general use cases, they also come in handy for specialized uses. For example, real estate firms leverage accounting virtual assistants for managing rent rolls or taking care of the property expenses

How to Outsource Accounting Tasks to a Virtual Assistant?

Figuring out the outsourcing process isn’t that difficult. But when you are looking for something special, you have to have a plan. Without a properly planned hiring process, you often end up with disasters.

Below, we are sharing a well-thought-out hiring plan that helps you outsource your accounting tasks to the best VA possible. Here’s how it goes –

Identifying What to Outsource

The very first thing you should do is find out which part of accounting is giving you the most pain. Maybe it’s entering data into spreadsheets or chasing down late payments. Or you may need someone to handle the whole accounting operation. Each specific need will decide what kind of outsourcing you should go for.

Selecting a Qualified VA

Never compromise on the qualifications of the virtual assistant you are outsourcing, just to save a few dollars. An accounting role requires someone who speaks the language of finance. A random virtual assistant can never fill those shoes. If you can’t find one, try out various virtual assistant services.

Keeping Clear Communication and Documentation

Clearly communicate what you need from the virtual assistant. Document things properly so whenever they see them, they instantly understand their duty. Try keeping it simple with a checklist or a quick Loom video.

Granting Secure Access to Tools and Data

You can never compromise with security when it comes to finances. Use complex passwords or advanced password management tools like LastPass. A better option is to create a specific user account for your VA in your banking software. Give access and permission to view and edit information accordingly.

Reviewing Performance and Giving Feedback

Being hands-on for the first few weeks of outsourcing is very important. See what the virtual assistant is doing right and what they are doing wrong. Then, based on that, provide them feedback and implement the necessary changes to build a working system.

Risks to Avoid When Outsourcing Accounting Tasks to a Virtual Assistant

Outsourcing isn’t all rainbows and sunshine. There are some pitfalls to outsourcing accounting tasks that you need to avoid while on this path. Here’s what you need to be wary of –

- Data Security Breaches: As the entire process takes place online, there’s a high risk of data breaches. That’s why you have to put the highest priority on the security and safety of your data with outsourcing.

- Loss of Control: If you don’t hand over the work properly to the virtual assistant, you may end up with messy work. The control goes to the VA without proper instructions.

- Hiring an Unqualified VA: An underqualified VA will surely make mistakes at some point. Accounting is something you can’t afford mistakes in. Mistakes cost money.

- Poor Communication: Good communication is the only way to ensure quality and compliance in outsourcing accounting tasks. Without that, you are bound to struggle with the quality of work.

- Dependency Risk: You are highly dependent on a remote worker when outsourcing accounting tasks. It can be a bit risky as they can leave or take a break at any time, leaving you stranded.

How Can an Accounting Virtual Assistant Help Accounting Firms?

Accounting virtual assistants offer a range of benefits, even for accounting firms. Here’s what you can get from outsourcing a virtual assistant –

1. Administrative Support

Accounting firms have to deal with a lot of paperwork and client coordination. A virtual assistant can ease that burden with their administrative skills. Things like organizing digital files or managing the CRM to ensure running operations.

2. Bookkeeping & Financial Management

Since accounting virtual assistants have accounting and finance knowledge, they can also handle bookkeeping tasks. It can be something like entering daily transactions or reconciling bank statements to keep the books clean.

3. Tax Preparation & Compliance

The tax season is a troubling time for any accounting firm because of the overwhelming data. That’s when they can rely on a virtual assistant to help them chase clients for missing receipts or organize tax documents.

4. Payroll Processing

When firms manage payroll for multiple clients, they can often lack the manpower or attention to detail. Outsourcing accounting work to virtual assistants helps them process payroll and retain clients.

5. Client Support

Apart from accounting tasks, virtual assistants can also work as the first point of contact for them. As they have accounting knowledge, they can ask the basic questions to get started with a client and support them afterwards.

6. Marketing and Social Media

As accounting firms are experts in finances, they often lack the expertise in marketing. This is where they can rely on a virtual assistant with marketing expertise to help them grow. It can be increasing their LinkedIn presence or managing email marketing campaigns to grow their client base.

7. Research & Analysis

Straight up, accounting firms can hardly make time for research and analysis to develop further. They can outsource this task to a virtual assistant to help them compare new financial software or research tax regulations.

While all these may look like outsourcing bookkeeping virtual assistants, there are specific differences between them. Check out “What is a bookkeeping virtual assistant” to learn more.

What Are the Tools to Outsource Accounting to a Virtual Assistant?

The key to a successful outsourcing relationship with an accounting virtual assistant is choosing the right tools. There are plenty of cloud-based virtual assistant tools that make it all happen.

- QuickBooks: It is the ideal gold-standard tool for small-business accounting, with robust multi-user access.

- Xero: The perfect tool to have for collaborating with unlimited users.

- FreshBooks: An ideal choice for service-based businesses requiring a simple invoicing and expense tracking system.

- Zoho Books: Works well with an existing Zoho ecosystem thanks to its end-to-end accounting features.

- Wave: It’s a free and user-friendly option for those who are new to the game.

- Sage 50 Accounting: The first choice of traditional firms with a powerful desktop solution with cloud access.

- FreeAgent: Customized for freelancers and contractors to manage expenses and tax estimates with ease.

Conclusion

In conclusion, you can change the whole accounting game for your business if you learn how to outsource accounting tasks to a virtual assistant. It’s a strategic move to free up time, reduce operational costs, and ensure accurate financial records.

So, any business buried in spreadsheets and struggling to focus on growth should make this change. A virtual assistant won’t just be a helper, but a partner to your journey of growth.

FAQs

How much does it cost to outsource an accountant?

Outsourcing an accounting virtual assistant can cost you from somewhere around $10 to $20 per hour.

Can internal audits be outsourced?

Yes, internal audits can be outsourced. You can choose a fully or partially outsourced option based on your needs.

When should businesses outsource accounting tasks?

It depends on certain scenarios. For instance, if you are overwhelmed with accounting data. Or if you need special accounting expertise on a certain project. Or you want to cut the costs.

How do you ensure data security when outsourcing accounting to virtual assistants?

Ensuring data security comes down to using strong contracts, implementing strict access codes, and leveraging secure tools.